Bank Reconciliation Templates 1450

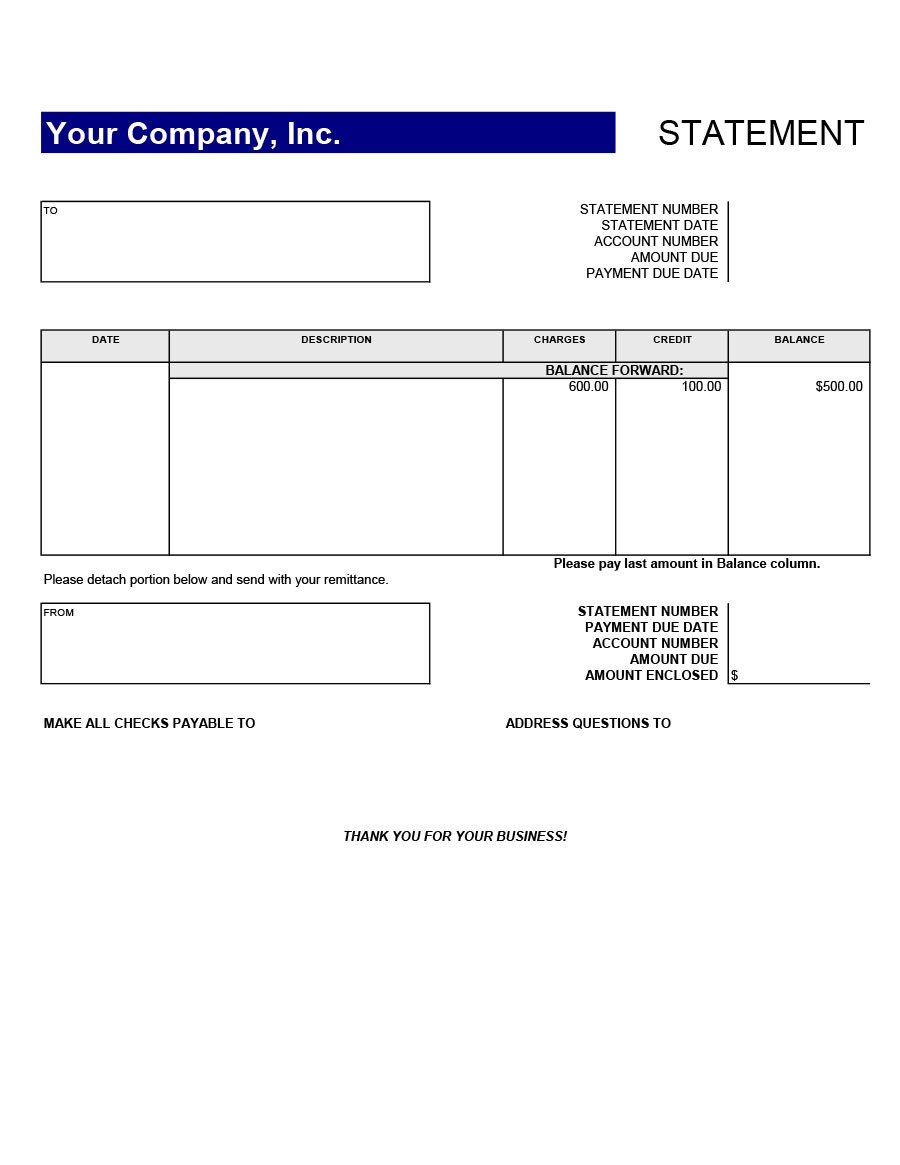

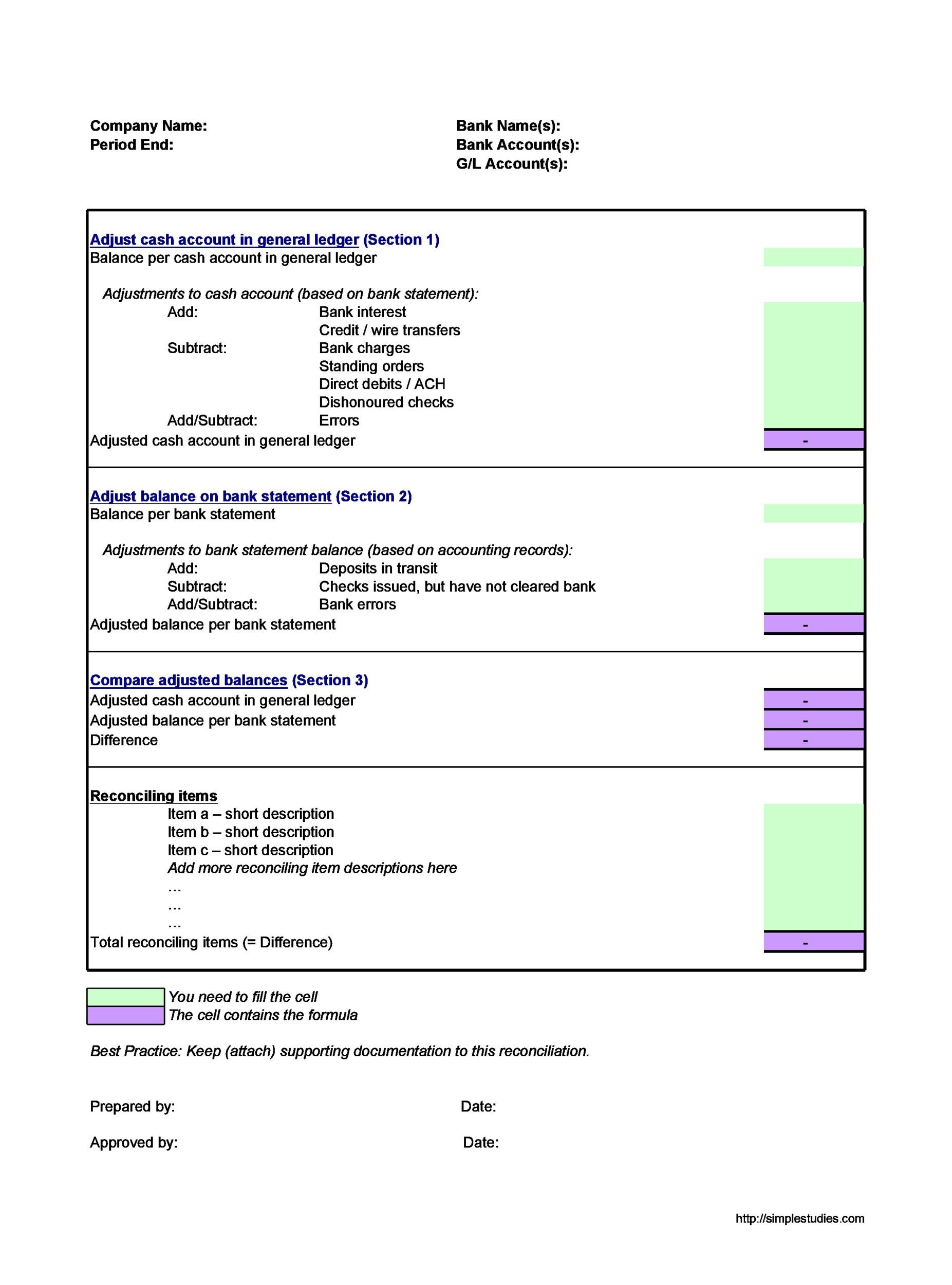

Explore our comprehensive collection of bank reconciliation forms, meticulously crafted for precise financial tracking. These tools ensure accurate alignment of bank statements with accounting records, supporting effective financial management and accountability within your organization.

Description

Tips for Utilizing Bank Reconciliation Templates

- 1. Maintain Accurate Records: Ensure all transactions are precisely recorded in both your bank statements and financial ledgers to streamline the reconciliation process.

- 2. Identify Discrepancies: Regularly compare your bank transactions with your records, checking for inconsistencies such as missing entries, duplicate charges, or unauthorized transactions.

- 3. Prioritize Timeliness: Conduct bank reconciliations promptly, ideally monthly, to identify and address errors or fraudulent activities early, protecting your business